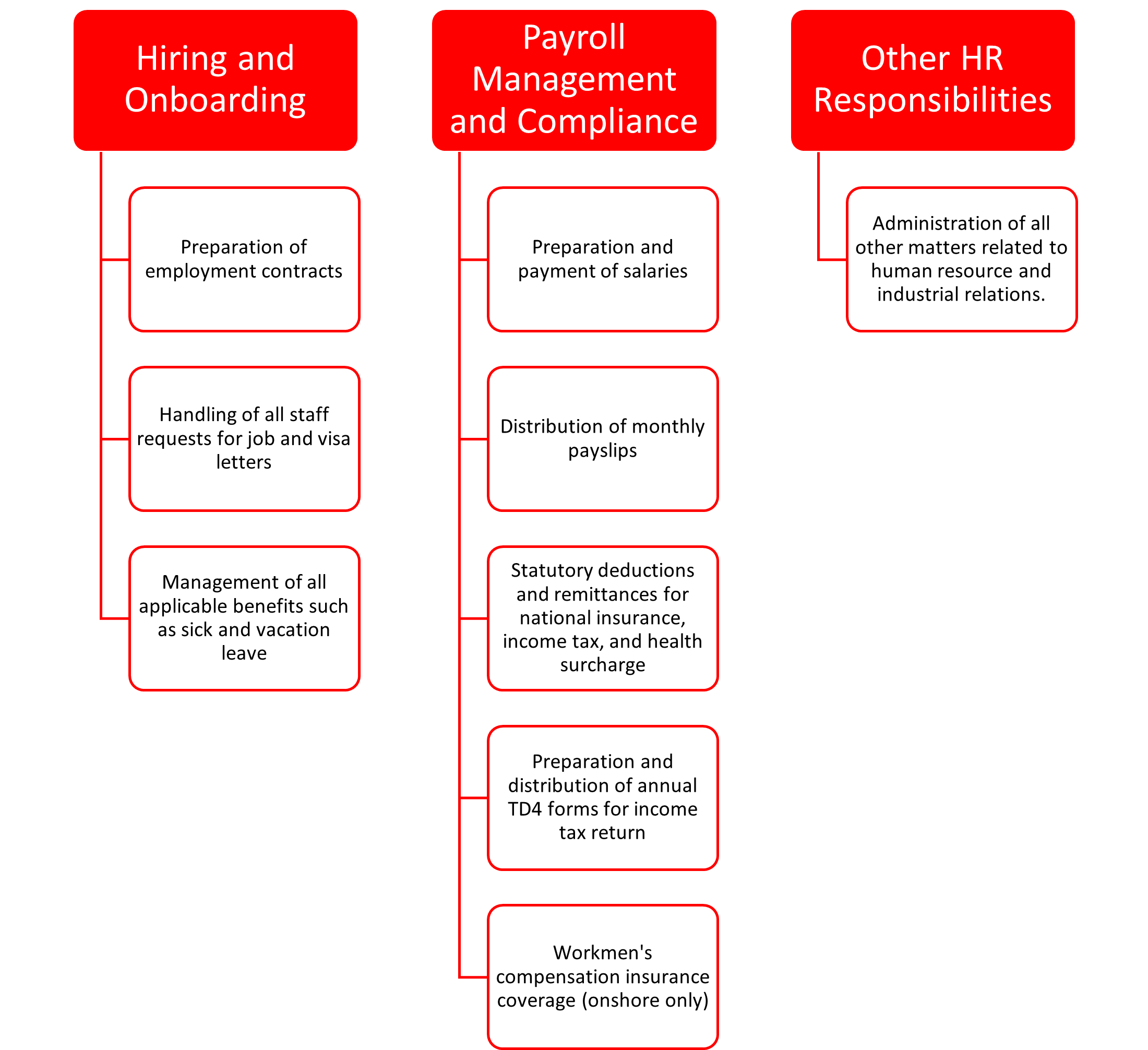

HR and payroll administration for EOR services involves a wide range of functions, including but not limited to:

Compliance with local employment laws and regulations:

- We ensure that the company is compliant with all relevant laws and regulations related to HR and payroll, including tax laws, labour laws, and social security laws.

Payroll processing:

- We assume responsibility for processing payroll for the company's employees, including calculating and deducting taxes, social security contributions, and other mandatory payroll taxes.

Benefits administration:

- We manage employee benefits, such as helath insurance, retirement plans, and other benefits required by local laws. To learn more about these benefits administration click here to download RXL's EoR Handbook.

HR administration:

- We manage employee records, handle employee queries, and provide support on HR-related matters where applicable.

At RecruitmentXperts Ltd, once the onboarding process has been completed and all relevant information and documentation have been received, the Agency assumes responsibility for the following:

To learn more about HR and payroll administration, click here to access our EOR handbook.